Introduction

When it comes to building wealth, most investors chase quick profits — but history proves one thing:

“Time in the market beats timing the market.”

Long-term investing isn’t about predicting short-term moves; it’s about letting compounding, patience, and quality businesses work for you. Let’s understand why long-term investing always wins and how you can use it to grow your wealth steadily.

What Is Long-Term Investing?

Long-term investing means holding stocks, mutual funds, or ETFs for 5–10 years or more, allowing them to grow through business expansion, dividends, and compounding returns.

Instead of reacting to daily price changes, long-term investors focus on:

- The company’s fundamentals

- Its earnings growth

- And market cycles that average out over time

The Power of Compounding

Compounding is the single biggest reason why long-term investing wins.

Example:

If you invest ₹10,000 every month for 20 years at an average return of 12%, your corpus becomes ₹99 lakh+, even though you only invested ₹24 lakh.

(Graph idea: “Investment vs Returns Over Time” — X-axis = Years, Y-axis = Portfolio Value)

This happens because you earn returns on both your capital and your past returns — the longer you stay invested, the faster your wealth grows.

Historical Proof: Markets Reward Patience

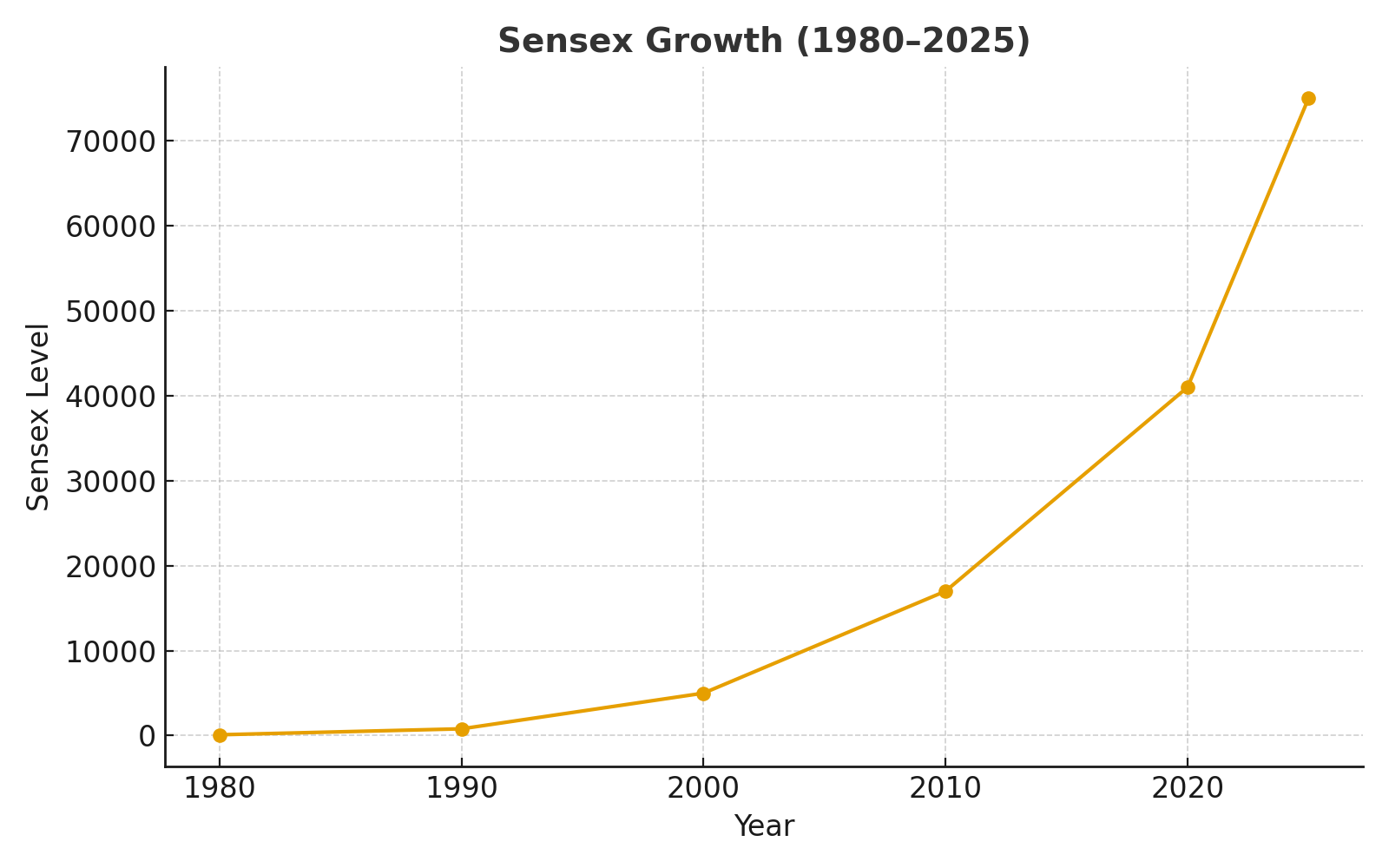

The Indian stock market has always grown over time despite short-term crashes.

| Period | Sensex Start | Sensex End | CAGR |

|---|---|---|---|

| 1980–1990 | 100 | 800 | ~24% |

| 1990–2000 | 800 | 5000 | ~20% |

| 2000–2010 | 5000 | 17,000 | ~13% |

| 2010–2025 | 17,000 | 75,000+ | ~10% |

Even though markets crashed in 1992, 2008, 2020 — they always recovered and created new highs.

(Graph idea: Sensex Growth Chart from 1980–2025 — shows upward long-term trend despite dips)

Why Long-Term Investing Works

- Reduces Risk – Market volatility evens out over longer periods.

- Tax Efficiency – Long-term capital gains are taxed lower than short-term.

- Lower Stress – No need to track daily prices or time the market.

- Power of Compounding – Returns grow exponentially after 5–10 years.

- Dividend Growth – You earn regular income while holding quality stocks.

Example: HDFC Bank and Infosys

If you had invested ₹1 lakh in HDFC Bank in 2003, it would be worth over ₹40 lakh+ today.

The same ₹1 lakh in Infosys would be ₹25 lakh+ — purely by holding and reinvesting dividends.

(Graph idea: Line chart comparing HDFC Bank, Infosys, and Nifty returns over 20 years)

Short-Term Trading vs Long-Term Investing

| Factor | Short-Term Trading | Long-Term Investing |

|---|---|---|

| Time Horizon | Hours to weeks | 5+ years |

| Risk | Very high | Moderate to low |

| Focus | Price movements | Business growth |

| Tax Impact | 15% short-term tax | 10% long-term tax |

| Returns | Unpredictable | Compounded growth |

Conclusion: The odds favor long-term investors.

How to Become a Successful Long-Term Investor

- Choose fundamentally strong companies.

- Diversify across sectors (IT, Pharma, Banking, FMCG).

- Invest regularly (SIP or monthly contribution).

- Avoid panic selling during market corrections.

- Stay invested through ups and downs — let time do the magic.

Key Takeaways

- Long-term investing turns volatility into opportunity.

- Compounding works best with time + consistency.

- Indian markets have rewarded patient investors for decades.

- Focus on business growth, not stock price movements.

Final Thoughts

The stock market is not a casino — it’s a wealth-creation machine for those who stay patient.

When you hold quality stocks for the long term, you don’t just earn returns — you build financial freedom.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett