Investing in the stock market can be rewarding, but making informed decisions is essential. Before buying any share, you must check these seven things: chart pattern, promoter holding, promoter pledge, company debt, shareholding pattern, about the company, and company management. Let’s dive into these factors to understand why they are crucial and how you can evaluate them.

1. Understanding Chart Patterns

Always investigate a company’s long-term chart pattern, not the short-term one. Long-term means the maximum time frame chart pattern. If the pattern trends from low to high from left to right, then understand that the company is good for the long term.

If the pattern trends from high to low from left to right, then understanding the company may be risky.

2. Examining Promoters Holding

Definition of Promoters Holding

Promoter holding refers to the percentage of shares owned by the company’s promoters. Promoters are the entities or individuals that establish the company.

Why Promoters Holding is Important

A high promoter holding often indicates confidence in the company’s future, while a low holding might raise concerns.

How to Check Promoter Holding

You can find this information in the company’s quarterly reports or on financial websites like the NSE or BSE.

3. Investigating Promoter Pledge

What is the Promoter Pledge?

Promoter pledge occurs when promoters use their shares as collateral to secure loans.

Impact of Promoter Pledge on Shares

A high level of pledged shares can be risky as it indicates financial stress and can lead to a fall in stock prices if the lenders sell the shares.

How to Find Information on Promoter Pledge

This data is available in the company’s quarterly disclosures and on stock exchange websites.

4. Assessing Company Debt

Importance of Analyzing Company Debt

Company debt levels are critical as excessive debt can lead to financial instability and affect profitability.

Key Debt Metrics to Consider

- Debt-to-Equity Ratio: Measures the company’s leverage.

- Interest Coverage Ratio: Assesses the company’s ability to pay interest on its debt.

Tools for Checking Company Debt

Use financial statements and resources like Yahoo Finance or Reuters to get detailed debt information.

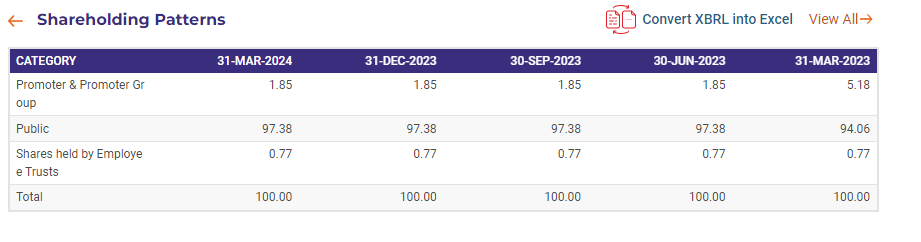

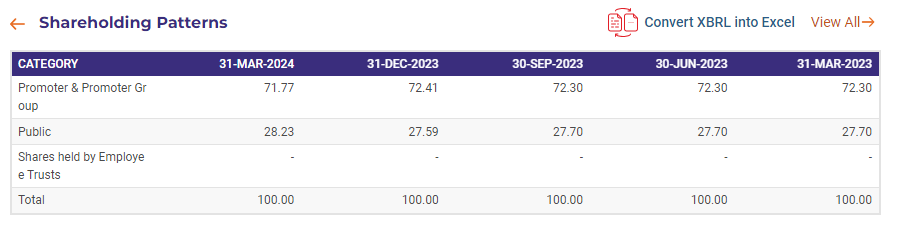

5. Analyzing Share Holding Pattern

What is Share Holding Pattern?

The shareholding pattern shows the distribution of shares among various stakeholders, including promoters, institutional investors, and the public.

Significance of Share Holding Pattern

A balanced shareholding pattern can indicate a healthy distribution of ownership and potentially less volatility.

How to Analyze Share Holding Patterns

Review quarterly reports and financial portals that provide this information.

6. Learning About the Company

Importance of Company Background

Understanding a company’s history, business model, and industry position is essential for assessing its long-term potential.

Key Information to Look For

- Company History: Track record and major milestones.

- Business Model: How the company makes money.

- Market Position: Its standing relative to competitors.

Resources for Researching Companies

Company websites, annual reports, and market analyses from financial news sites are valuable resources.

7. Evaluating Company Management

Role of Management in Company Success

Effective management is crucial for strategic direction and operational efficiency.

Indicators of Strong Management

- Leadership Experience: Background and track record of the leadership team.

- Strategic Vision: Management’s future plans and strategic initiatives.

- Performance Metrics: Historical performance under the current management.

How to Evaluate Management Quality

Read interviews, annual reports, and analyst opinions to gauge management quality.

Conclusion

Conducting thorough research and analysis is crucial before investing in any share. By checking chart patterns, promoter holdings, promoter pledges, company debt, and shareholding patterns, understanding the company, and evaluating its management, you can make more informed and confident investment decisions. Remember, informed investing reduces risks and enhances potential returns.

FAQs

1. What is the most important factor to consider when buying shares?

While all factors are important, understanding the company and its management is often crucial as they directly impact long-term performance.

2. How often should I review these seven factors?

To stay updated with any significant changes, this should be done regularly, ideally quarterly, in line with the release of financial reports.

3. Can I rely solely on one of these factors for my investment decision?

No, a holistic approach considering all seven factors provides a more comprehensive view and reduces risks.

4. Where can I find reliable information on these factors?

Financial websites, stock exchange portals, company reports, and news outlets are reliable sources of information.

5. How do I keep updated with changes in these factors?

Set up alerts on financial news apps, follow market analysis, and subscribe to company newsletters for timely updates.